31: Inflation Is Coming Down

Good afternoon and happy Monday! Spring break is over, earnings season looms near, and the economy is still ripping, and inflation is coming down. Here's what we're getting into this week:

Table of contents

What's New

Table of contents -- You can now click to scroll using the table of contents, and you'll be taken right to the appropriate header! Try it out by clicking "Internet Gems" above.

Quote of the week

"The more aware we are of our basic paradigms, maps, or assumptions, and the extent to which we have been influenced by our experience, the more we can take responsibility for those paradigms, examine them, test them against reality, listen to others and be open to their perceptions, thereby getting a larger picture and a far more objective view."

Stephen R. Covey, The 7 Habits of Highly Effective People

Markets

The S&P 500 gained this week while the Nasdaq slipped slightly. Oil and gold are up.

The S&P 500 gained quite a bit since the Oct '22 lows. Remember how much fear everyone had then? Of course, who knows, we might have a decimating downturn starting tomorrow.

All I know is I'm going to keep buying and looking for wonderful businesses.

Subscribe

Get posts just like this one sent to your inbox when they're published:

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you!

Economy

Core PCE came in slightly lower at 2.78%. This is great news. I was a bit fearful that inflation would rise this month, but I was wrong. We can see, however, that the rate of decrease is slowing ever so slightly.

I still think it's pretty amazing how much the Fed has been able to squash inflation without destroying the economy. It's commendable.

The slight decrease in rate doesn't really mean anything other than a return to the average. The longer we look out, the more likely it is we'll have normal inflation of ~2%.

It's important to remember here that decreasing inflation rates mean prices are increasing slower than they did in 2021, 2022, and 2023, not that prices are going down. The above chart would show a negative value if prices were declining. I hope that makes sense.

Sectors

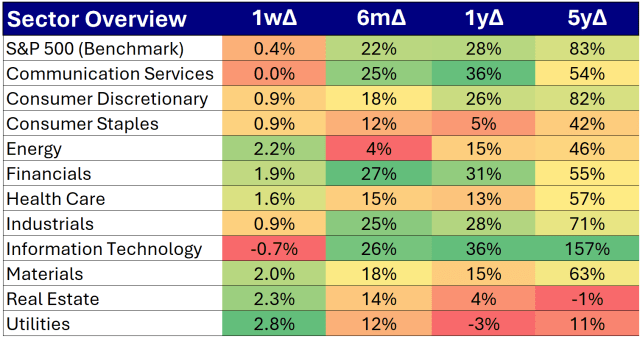

Utilities had a hell of a week with energy right behind.

Internet Gems

John Huber with Saber Capital Management posted this in 2016:

However if you aiming to compound capital at high rates, I believe you should spend time focusing on businesses possessing a Reinvestment Moat with a very long runway. These businesses exhibit strong economics today, but more importantly possess a long runway of opportunities to deploy capital at high incremental rates. If these are hard to come by, the next best alternative is a business with the combination of a Legacy Moat and an exceptionally strong capital allocator. It will take some work and a lot of discipline to filter down to the true compounding machines, however a portfolio of these exceptional businesses acquired sensibly is likely to produce years of strong returns.

If you know of any other great writing like this, please send it my way.

Process

For a while I used Atom Finance as a news/filings aggregator, but they recently "changed gears" and discontinued their service. So, I tried Koyfin thanks to an OG member. So far Koyfin is great. They have a watchlist news feature where I can filter news for my watchlist which is very important. On top of that, I can filter in/out what I want or don't want. For example, I can filter out ownership docs and filter in transcripts and certain news. Check it out:

I am not affiliated with Koyfin in any way. I'm just a proud user. You can check them out here: https://koyfin.com/

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post 31: Inflation Is Coming Down appeared first on Walsh Investment Strategy.