🔥💼 Intel New CEO Lip-Bu Tan

Thoughts on new CEO and portfolio positioning regarding recent "win"

📈 Stock Reaction

Intel appointed a new CEO, Lip-Bu Tan. Investors loved the news. Stock price is up ~29% in the last 5 days:

📝 The Letter

Tan recently released a letter to INTC 0.00%↑ employees. You can read it here https://www.intc.com/news-events/press-releases/detail/1732/remaking-our-company-for-the-future

Some things that stood out to me:

1. Hitting the ground running

The first words out of your mouth as a leaders should set the tone for what is to come, what is expected, and what is intended. Tan is doing that very well here.

I am joining because I believe with every fiber of my being that we have what it takes to win.

I hear Tan comes from a sports background, which is great. I hope he brings the heat to win.

2. Focusing on moving the needle

Intel has had a lull in focusing on engineering first. Gelsinger brought the emphasis on engineering back to Intel, but he may have been a little overzealous about plans and overemphasis on foundry before products.

Tan has a slightly different take, retaining the engineering focus, but putting products at the forefront:

Under my leadership, Intel will be an engineering-focused company. We will push ourselves to develop the best products, listen intently to our customers and hold ourselves accountable to the commitments we make so that we build trust.

The last touch on commitments and trust is essential right now for Intel. They are on the brink of losing trust with all major potential customers.

3. Core Beliefs

I love how Tan is putting his philosophy out there right away:

I subscribe to a simple philosophy:

Stay humble.

Work hard.

Delight our customers.

When you anchor yourself in those three core beliefs, good things happen.

Intel got complacent and suffered from “king syndrome” in the past. King syndrome is what happens when a company rises to the top, stops taking risks, and loses their edge. All the while retaining the belief that “we are the best and cannot possibly fail. Look how good we are!” Then ultimately lose market share to competitors. Intel started to turn things around with Gelsinger and the culture, and Tan hopes to continue this trend by leading with “stay humble.” Let’s hope it works.

If they’re going to work hard, they need to cut the fat and trim positions. I guarantee Intel has bloated departments. I expect cost-cutting measures soon.

If they hope to delight customers, they need to focus on eliminating execution risk.

4. Number One Priority

If you can’t deliver for customers, you won’t make it. Good to get that out there:

Now more than ever, our customers are counting on us to pull together as a team and deliver for them. Above all else, that is and will remain our number one priority. And as your CEO, I will empower leaders to take ownership and actions to move our business forward.

Lastly:

5. Big Three

Re-emphasis on products first, then foundry:

Together, we will work hard to restore Intel’s position as a world-class products company, establish ourselves as a world-class foundry and delight our customers like never before.

💼 Portfolio

INTC is now ~23% of the portfolio, and still undervalued IMO. My window is the next 5 years with this position, and I think it might take that much time to realize INTC potential.

The reason for such a heavy weighting is

The (seemingly) obvious geopolitical necessity for Intel to succeed for the United States of America, combined with

The severe discount INTC stock resides right now.

Targets

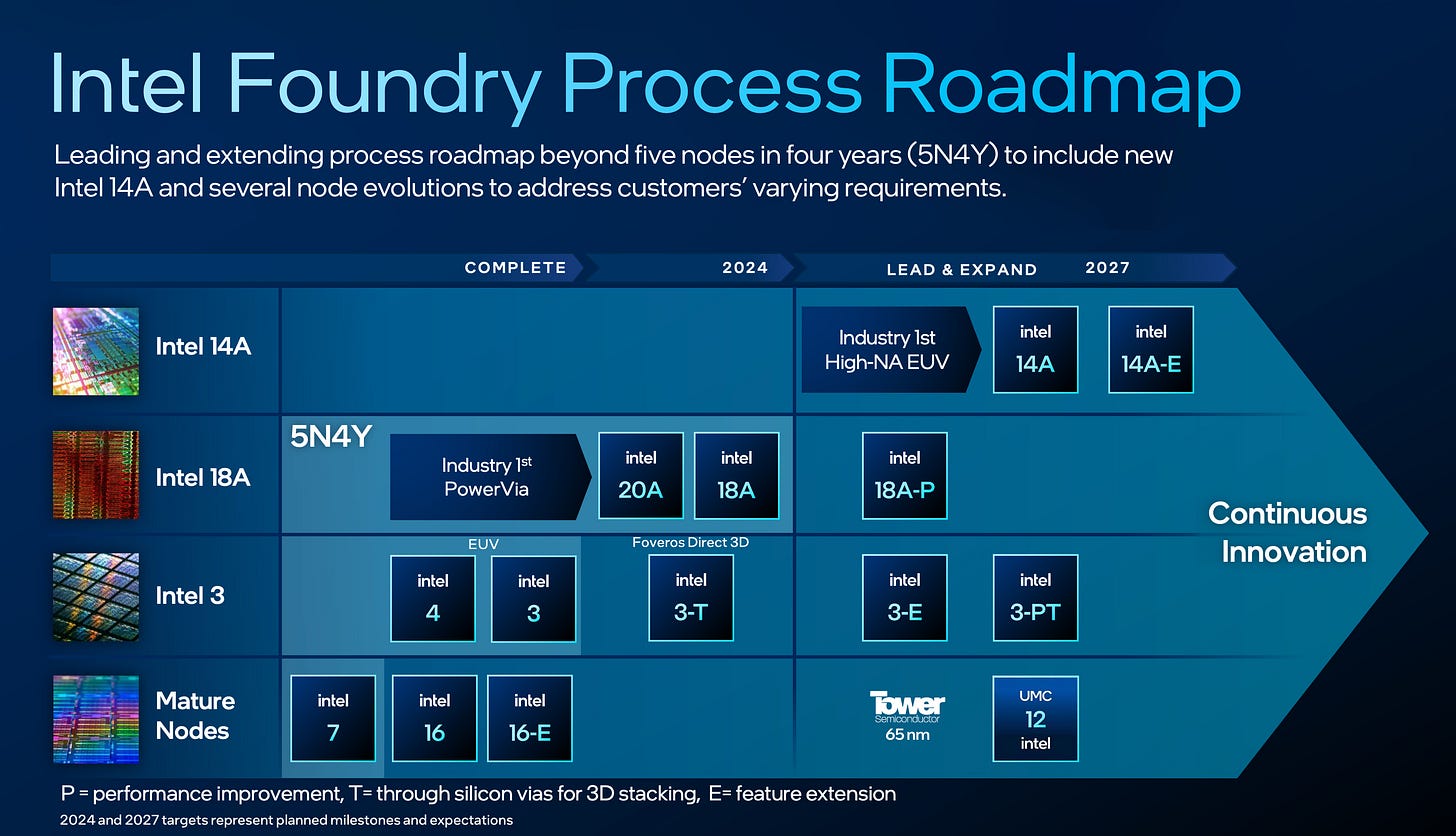

I’ll be watching for execution in 18A, 14A, and beyond:

I’ll also be watching for increasing customer base with Mag7 and other larger players.

Pre-Mortem

Between the general undervalued state of the stock, and the underplayed role of Intel in geopolitical arena, I think INTC has a shot at triple or more in 5 years from here.

For the sake of timestamp, I’ll strongly consider trimming my position of INTC reaches forward p/e of 50.

Conversely, if Intel and team can’t do what they say, I’ll be trimming the position accordingly.

🥳 Conclusion

Overall, I love the letter and where Intel sits on both quality and price. Lip Bu Tan wrote a solid letter. It’s a small window into how Tan thinks, and I appreciate that. “If you listen to a man talk long enough, he’ll tell you exactly what’s on his mind.”

I hope Tan is one to do what he says. I’ll be watching and rooting for Intel.

Disclaimer

The information provided herein is for informational and educational purposes only and should not be construed as financial or investment advice. I am not a licensed financial advisor nor am I acting in any fiduciary capacity. The opinions, assumptions, and estimates expressed represent my judgment as of the publication date and are subject to change without notice. I make no representations, warranties, or undertakings—express or implied—regarding the accuracy, reliability, completeness, or reasonableness of the content. Projections are based on various assumptions, and there is no guarantee that these outcomes will be achieved. Please conduct your own due diligence, consider your own risk tolerance, and consult with a professional before making any financial decisions. Past performance is not indicative of future results.