Texas Instruments: First Look

Texas Instruments (TXN) is known for their fiscal discipline which grabs my attention instantly. Not only are they disciplined, but their overall business is one of top-notch quality. In this post I cover the fundamentals of the business and stock valuation. This post is mostly free, so feel free to share with your friends or anyone who you think would enjoy learning about the fundamentals of Texas Instruments. Let’s dig in.

Table of contents

Fundamentals

Texas Instruments is easy to understand but very difficult to emulate. They “design, manufacture, test and sell analog and embedded semiconductors in markets that include industrial, automotive, personal electronics, communications equipment and enterprise systems.” Their primary segments are industrial and automotive.

Business Segments

While industrial and automotive segments are expected to grow significantly, I (and others) expect personal electronics segment to lag or decline in the coming years.

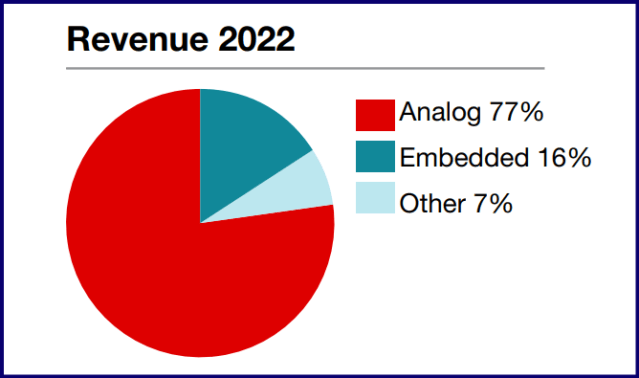

If you were wondering just how much of TXN revenue comes from analog chips, here you go:

Part of the main difficulty I’ve had to overcome was the disconnect between the value of cutting edge technology and essential technology. While investing in new tech is exciting, essential tech is, well, essential. This puts TXN in a peculiar position of stability, good margins (which we’ll cover below), and market leadership.

Capital Allocation

My favorite words in investing are discipline, free cash flow, and leadership, and return on invested capital.

While TXN is the largest analog chipmaker, they still command high margins:

While Free Cash Flow has taken a hit lately, I think with their operational foresight, TXN will once again generate meaningful FCF per share.

Another aspect that I like quite a bit with TXN is their historical ROIC. Hovering between 30-40% is great for a mature company like TXN. The recent dip down to 25% shows their investment into future production.

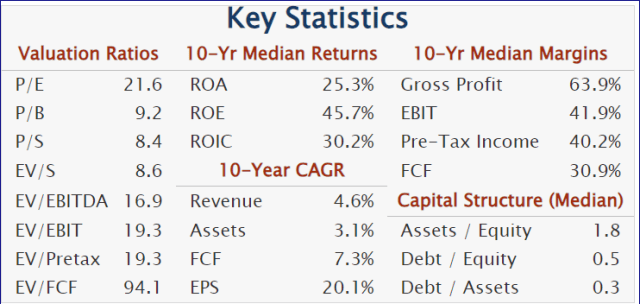

Margins look good, ROIC looks good, but let’s look at 10 year metrics:

I see a boring company with great numbers. Low debt, good margins, solid growth.

A quick note on performance: TXN has outperformed the index for the last ten years. (This does not include dividends for either the index or TXN):

Moat

When I learn about TXN I immediately think of “how are they better than the rest of the competition?” This is a question that requires nuance and careful examination of the competitive environment. A few things I notice:

TXN is the largest producer of analog and embedded chips.

TXN designs, builds, tests, and sells most of their products. This is especially nice to see when weighing TXN as an antifragile investment option. Many semiconductor companies do not build their products while others do not test their products. TXN does almost all of it in-house, which helps with margins over the long term.

TXN invests in building quality so that their products have a sort of lock-in effect. While they are not the cheapest option for many of their products, they are the best. This coupled with the nature of analog chips, secures their spot as the leader. Why? Because when you’re making a relatively low-cost and high-payoff product, customers want the better option. It does not pay to be the lowest cost option here. If customers wanted to pay a few pennies less, they would pay for it 10x in headaches.

Demand for analog and embedded is going up steadily and will be for a long time (sans end of the world scenarios).

If you know me then you know I’m very interested in investing in American stationed companies. TXN is American which is a great thing in this era of geopolitical chess.

TXN was the first to manufacture 300mm wafers in analog semiconductors. They started in 2009 when they bought an IFX fab, which led to increased margins.

Risks

One of the main risks with TXN is their exposure to China. While this isn’t nothing, it’s also not something I worry about too much. Since their chips are low-tech, I can’t imagine leadership from either country limiting their business. Less TXN chips in China hurts China, and it hurts TXN and the US. I could understand if these were state-of-the-art GPUs from NVIDIA but that’s just not the case.

Leadership

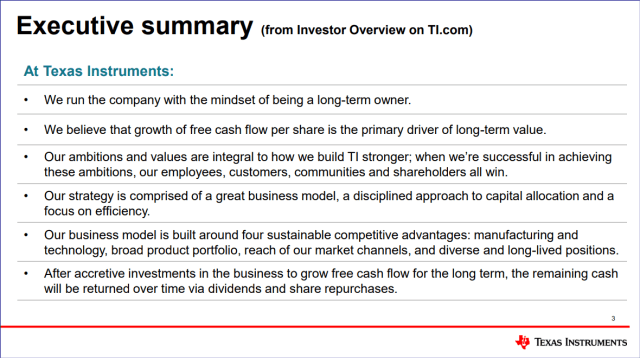

One of the things I like the most about TXN is their leadership. They communicate, take care of their investors, and mostly the execute on the topics they discuss. One of the best pieces on TXN is their very own capital management presentation which you can find here: Capital Management 2023. Here’s a few of my favorite slides:

Alignment

Everything about this screams “BUY ME”. Points number 1 and 2 are enough to hook me (and other value focused investors). The rest of the points expand on points 1 and 2.

2. Competitive Advantages

The manufacturing and technology base is something we’ll have to learn and discover as we go forward. I am no engineer, so any information about the why TXN makes better products than others will have to be learned from the ground up. Lucky for us, everything is learnable.

note: Do not confuse learning with becoming an expert overnight. We will focus on learning what’s important for investors, not every minute detail within TXN.

3. Long Term Planning

You can see the cycles in Units Shipped TTM. The thing about this slide is it’s such a focus on long long term. Going all the way back to 1989 and planning forward to ~2030 isn’t nuts when you have this sort of track record of execution. Very good to see.

4. R&D in Automotive and Industrial

Another thing I like to see is this increase in R&D around industrial and automotive segments. While this might be painful for short term margins, long term it should help widen the moat, and margins, for TXN. Very good to see.

Valuation

Historically TXN hovers around 20 P/E while the latest as of 2023-12-21 is 21.1. NTM P/E is 24.6. Definitely not a bargain here but not expensive either:

With TXN being such a stable co, I’d be comfortable with buying in at roughly 20 P/E if my holding period was aimed at more than 5 years. “Quality businesses at reasonable prices” fits here. TXN is definitely quality, but I’d like to know more (of course).

Conclusion

From what I can see, Texas Instruments is a great company throughout. The biggest risk here is my own lack of experience with semis and the semiconductor industry. Blind spots are common in investing and they should always be taken seriously. That’s why I’ll be on the lookout for more information on what makes TXN special, and conversely, what makes TXN not so special. It’s easy to read a report like this, or a few, and think “I have a good understanding of this company” when the truth is we don’t know hardly anything. Over time I hope to uncover the DNA of Texas Instruments so that you and I can know what we’re investing in. So far, it looks good.

The post Texas Instruments: First Look appeared first on Walsh Investment Strategy.