2023 Annual Letter

Estimated reading time: 5 minutes

It's been a great year and it's been a tough year. We finished with 48.7% performance.

For this year's letter I'll keep it simple:

Table of contents

Performance

The S&P 500 is my benchmark with dividends reinvested. This is the SPXTR. The benchmark returned ~25% while we returned 48.7%. Not bad at all.

Since inception numbers are also great as you can see here:

2023 was a year of pulling ahead significantly.

Here is a breakdown by month and quarter for those interested:

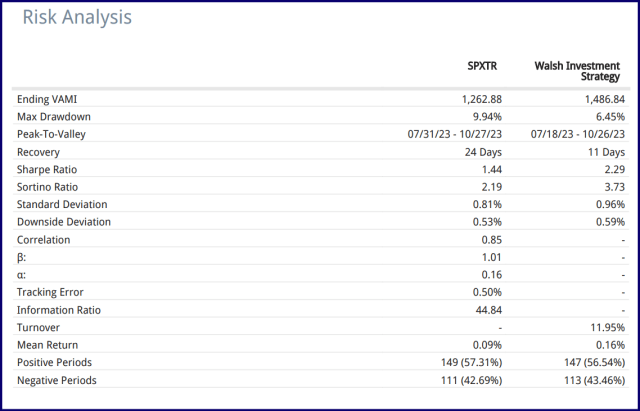

No performance is without risk. Here is the risk profile for the portfolio against the benchmark:

A few things to note:

A sharpe ratio of 2.29 is fantastic for a first full year in public equities, especially when compared to the benchmark sharpe of 1.44. I am very pleased with the results.

Low turnover of 11.95%. This goes to show that busy work does not equal success. Thinking clearly and staying calm is the name of the game. Of course, thinking clearly is a spectrum where no one is guaranteed clear thinking today due to success yesterday. In fact, due to this success I am more likely to not think clearly tomorrow.

Sector Contribution

I think this is important to note. I'm a firm believer in technology, but not at any price. Quality businesses that I can understand, at a reasonable price, is where it's at. This just so happens to gravitate towards the technological verticals: telecomm and technology.

It's no secret these sectors had a great year, and there's no guarantee that next year they'll outperform, or even return positive results, but that's something I'm willing to risk. I think an intelligent investor will become fearful when their holdings absolutely crush it, and that's what I'm experiencing now.

From here I'm going to discuss biggest contributors to portfolio performance along with valuation, strategy for 2024, specific wins, mistakes, and the current portfolio I have set up for 2024. If you want to read the rest you'll need a Pro membership or higher.

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post 2023 Annual Letter appeared first on Walsh Investment Strategy.