Cloudflare Q4’23 Earnings Update + First Look

Estimated reading time: 7 minutes

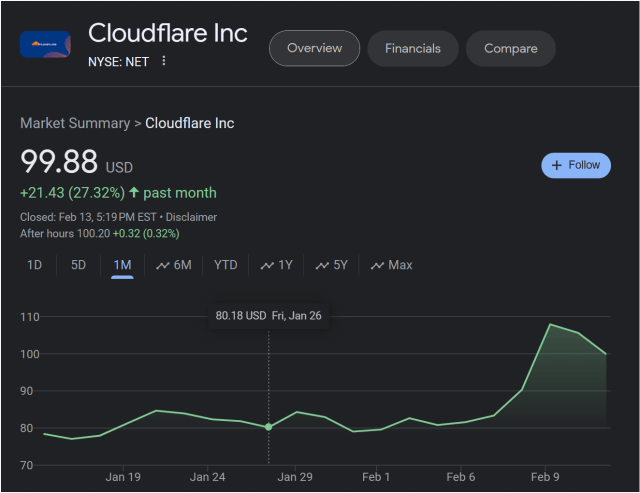

Cloudflare had a great Q4’23 and is quite an interesting company. After posting results the stock jumped ~30%. In this post I’ll cover quarter results, valuation, and some things that caught my eye.

Portfolio Note

Note: On January 25th I put out a portfolio update stating that I would enter a start position in Cloudflare (NET) on the 26th. (Members can read the see the full portfolio here.) Since then, Cloudflare has increased in price by 23% (as of 2024-02-13):

Given the extreme valuation of Cloudflare, I am wary of entering a position of any meaningful size greater than 1%.

Table of contents

Need To Know Terms and Ideas

Free Cash Flow

Imagine you have a lemonade stand. Your free cash flow (FCF) would be the money you have left after buying lemons, sugar, and cups (your operating expenses) and after buying a new pitcher or table (investments in your business). It’s the cash you can use to buy more supplies, save up for a rainy day, or even treat yourself to some extra goodies. A business exists to create free cash flow.

Free Cash Flow Margin

Think of free cash flow margin (FCF Margin) like the profit margin for your lemonade stand. It’s the percentage of your revenue that turns into free cash flow after covering all your expenses and investments. So, if you make $100 selling lemonade, and after buying ingredients and a new pitcher, you have $20 left in cash, your free cash margin would be 20%. It’s a measure of how efficiently you’re turning your sales into cash that you can use however you want. Usually, the higher the margin (%), the better!

Enterprise Value to Free Cash Flow (EV/FCF)

The EV/FCF ratio, or Enterprise Value to Free Cash Flow ratio, is a financial metric used to evaluate the valuation of a company relative to its free cash flow. Think of it as comparing the lemonade stand’s total value (including its debt) to the cash it generates. For example, if your lemonade stand is worth $1,000 (including any debts), and its free cash flow is $200 per year, the EV/FCF ratio would be 5 ($1,000 / $200). This ratio helps investors assess how much they’re paying for each dollar of free cash flow generated by the company, providing insight into its valuation relative to its ability to generate cash. Usually, the lower this number the better. However, a higher EV/FCF can signal that investors looking at a stock favorably. As of today, Alphabet (GOOG) has a EV/FCF of 24. Microsoft (MSFT) has an EV/FCF ratio of 42. Cloudflare (NET) has a EV/FCF of 251! That’s expensive!

Business Overview

What a cool company. Cloudflare makes the internet better, faster, and safer. From their latest presentation:

“The internet was not built for what it has become.” So they made a solution. It seems to be working!

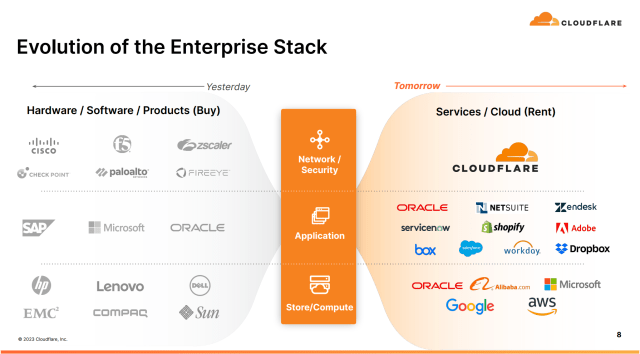

And lastly:

I am just now beginning to understand the impressiveness that is the technology that Cloudflare brings, and it’s not lost on me. Of course, technology is neat, but if it’s not solving a real-world problem, then it’s not a solid investment, no matter how cool the slides look. So let’s dive into the financials.

Here is the first slide from the presentation that I saved for last:

In business for >10 years

High gross margins

Lots of paying customers

Founder is CEO

I’m a happy customer!

Ok let’s dive in to the latest quarter and financials.

Subscribe

✓ Get smarter

✓ Invest wisely

✓ Never miss a thing

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you! (Your info is private and will never be sold to anyone else, ever.)

The Numbers

Some highlights from the 8-K:

Fourth Quarter 2023 Financial Highlights

Revenue: Total revenue of $362.5 million representing an increase of 32% year-over-year.

Gross Profit: GAAP gross profit was $279.2 million or 77.0% gross margin, compared to $206.9 million or 75.3%, in the fourth quarter of 2022. Non-GAAP gross profit was $286.0 million or 78.9% gross margin, compared to $212.5 million, or 77.4%, in the fourth quarter of 2022.

Operating Income (Loss): GAAP loss from operations was $42.8 million, or 11.8% of total revenue, compared to $50.7 million, or 18.5% of total revenue, in the fourth quarter of 2022. Non-GAAP income from operations was $39.8 million, or 11.0% of total revenue, compared to $16.8 million, or 6.1% of total revenue, in the fourth quarter of 2022.

Net Income (Loss): GAAP net loss was $27.9 million, compared to $45.9 million in the fourth quarter of 2022. GAAP net loss per basic and diluted share was $0.08 compared to $0.14 in the fourth quarter of 2022. Non-GAAP net income was $53.5 million, compared to $21.6 million in the fourth quarter of 2022. Non-GAAP net income per diluted share was $0.15, compared to $0.06 in the fourth quarter of 2022.

Cash Flow: Net cash flow from operating activities was $85.4 million, compared to $78.1 million for the fourth quarter of 2022. Free cash flow was $50.7 million, or 14% of total revenue, compared to $33.7 million, or 12% of total revenue, in the fourth quarter of 2022.

Cash, cash equivalents, and available-for-sale securities were $1,673.7 million as of December 31, 2023.

Fantastic YoY growth, even with the losses.

Stable Revenue Growth

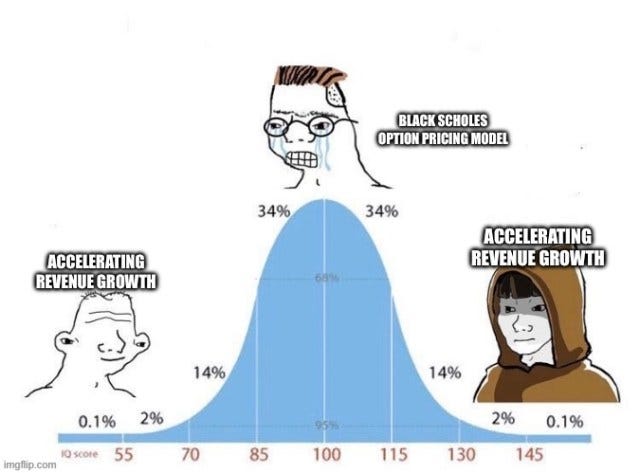

There’s stable revenue growth, then there’s Cloudflare revenue growth. Check this out:

Just amazing. I used to not care so much about stable or accelerating revenue growth, but I’ve come around to the idea that it’s possibly one of the best metrics out there.

Increasing FCF/Share and Margins

Free Cash Flow per Share (FCF/Share) has been increasing since Q1’23 with a recent Q4’23 FCF per share of 0.16.

This, combined with the increasing FCF margin, is a good sign of overall stability improvements in the business. A while ago, when the company was negative FCF margin, it wasn’t a good sign. Now it seems they are nearing the end of the dark woods, and into a new era of profitability.

However, the valuations are still outrageous:

Growing Share Count

One of the downsides so far for Cloudflare is their increasing share count:

I understand that stock-based compensation is a thing, especially when trying to attract talent, but the sheer growth of stock-based compensation is unnerving to me. Even with the increase of FCF/Share, the increase is nothing to sneeze at.

A Little Strategy That Works

From the latest earnings call:

. . . our strategy remains our strategy, which is land with one product and then demonstrate — build trust, demonstrate value and then expand to help customers both create more value and save money across their overall all platform. And what we see over and over again is that the customer that just this last quarter signed a $60 million total contract value renewal. They started with one product and were a $60,000 customer a year when they first started. So that works. I think operationalizing that now is the thing which we’ve made huge strides on over the last 15 months and I think Mark Anderson will continue to help with that.

I love this. It’s simple, effective, and fosters growth. You can’t have a simple strategy like this without providing some serious value. Well done, Cloudflare.

Conclusion — Great Business, Expensive Right Now

Growing like crazy, in-demand, great product, extreme lock-in, happy customer. However, they’re priced to grow to the moon right now. They need to minimize costs while continuing to grow. And this point worries me: they have billions coming in, lots of customers, but they are barely profitable. 182k customers, and not raking it in? That’s mind-boggling. With EV/FCF of ~250, and guidance suggesting 0.13 EPS next quarter, I’m happy with nothing more than a starter position.

Why a starter position and not on the watchlist?

IMO a starter position is for great companies that are expensive. It forces me to see volatility, pertinent news and earnings. A watchlist is for companies that might become great companies. Cloudflare’s expensive valuation tells of their consistent growth, winning strategy, and results-driven execution. The odds of them taking a hit to stock price vs continuing winning is small, so, starter position! It’s worked out well (so far), up 26%.

If you want to see my full portfolio, you can become a member here:

The post Cloudflare Q4’23 Earnings Update + First Look appeared first on Walsh Investment Strategy.