Intel New Segment Webinar Notes

Intel (INTC) announced they are reporting their segments differently moving forward to focus more on Intel Foundry. You can see the full presentation/slides/audio here: Intel New Segment Reporting

This post will cover relevant slides that caught my eye and address some considerations for the stock and the company.

Table of contents

Subscribe

Get posts just like this one sent to your inbox when they're published:

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you!

Summary

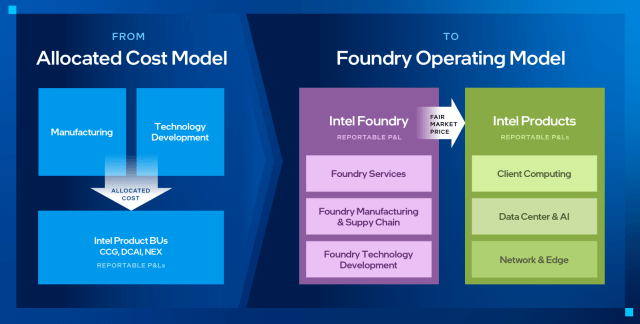

Intel is changing how they're reporting segments. It's not a huge change but sheds some light on what Intel and the leadership is focused on.

Intel New Segment Reporting Basics

Here's what's changing:

The main point here is the financial disclosures. ". . . Driving to achieve break-even operating margins midway between now and the end of 2030 . . ."

This is quite the pill to swallow. Intel is a mature company that went off the rails quite a bit and missed the mobile bandwagon, but those days are over. With IDM2.0 Intel might be able to make a comeback, but we are not in the business of investing to breakeven. I aim to own wonderful companies as long as they stay wonderful. (More on this later).

For now let's look at IDM2.0.

IDM 2.0

First off, I'm warry of slides like this that are the opposite of companies that let their results speak for themselves. However, Intel is not in the position financially to forego all branding guidelines. They need to play ball with institutional and retail investors. They need to look pretty right now:

However, IDM 2.0 is going well so far. Pat Gelsinger promised to innovate 5 nodes in 4 years (5N4Y).

5 Nodes in 4 Years

Each one of these iterations of technology is a miracle.

Back in 2021, Gelsinger was laughed at for his seemingly impossible task of bringing Intel back to the leading edge of the semiconductor industry. (Gelsinger became CEO in February 2021.)

Please keep in mind that this topic is beyond my area of expertise, but venturing into uncharted territory is a common aspect of investing. In the semiconductor industry, each node represents a new generation of advancements. While Intel's 18A node was their most advanced planned technology, the industry is relentlessly innovative and fiercely competitive. As Intel's history has demonstrated, resting on one's laurels can lead to a loss of market leadership.

So, here is what Intel has planned beyond 5 nodes in 4 years, finalizing in Intel 14A and 14A-E:

Beyond that, Pat Gelsinger spoke about "standard IP practices" with manufacturing these new nodes:

Here's a closer look (click to expand):

From what I understand, a lot of these technologies require Intel to work with other companies (like Cadence, Microsoft Azure, Ansys, etc.) in order to add key functionality to Intel chips. While this was a sore spot for Intel in the past, they're on track to include all of these technologies in the (somewhat) near future. Yay!

This next slide shows the competitiveness of new nodes from Intel. It's a goofy slide but useful information. Here's the legend:

Much worse than competitors: - -

Worse: -

Same: =

Same or better: +=

Better: +

Much better: ++

It'll be amazing if Intel can offer top-notch products to compete in the semiconductor industry.

What's more, Intel expects to compete with semi fab monster Taiwan Semiconductor Manufacturing Company (TSMC):

Feb 21 (Reuters) - Intel INTC.O on Wednesday said it expected to beat a 2025 deadline to overtake its biggest rival in advanced chip manufacturing and gave new details about plans to maintain that lead versus Taiwan's TSMC into 2026 and beyond.

Intel expects to overtake TSMC in making fastest chips this year | Nasdaq

This is great and all, but what about the profitability? Let's take a look.

Intel Profitability and ROIC

Now, this is the most important slide from the whole webinar. The number one long term measurable metric that I can think of is Return On Invested Capital (ROIC), that teeny white diamond. Intel and Pat Gelsinger paint a picture of redeemed ROIC in 2030. That feels like a long way away, and it is for a lot of people, but this is a game that is important to national security. Right now the USA gets most of its chips from overseas. This isn't inherintly a bad thing, but when you layer in the current macroeconomic and geopolitical events, it makes sense to have a home-base of chip reliability.1

Margins for the long term don't look so good.

The geopolitical point for Intel is amazing.

The last thing here is the second point of the strategy: "say/do ratio is high." This is the main point that most investors are missing. After Intel published this webinar, the Intel stock took a dive of roughly 7%. What they don't know is Intel and Pat Gelsinger are making a big bold bet on the future, one where the United States regains leadership in the semiconductor industry.

INTC Stock Questions

Is Intel a wonderful company?

Intel is obviously in hot water, regardless of how amazing their products are. The question is, is Intel a wonderful company at a reasonable price? Terrible margins, decreasing revenues, and a rough Return On Invested Capital (ROIC).

If I saw these charts without the understanding of the business, I'd run as fast as I could from INTC stock. But, the numbers and the narrative both have a place in investing.

Is Intel stock a reasonable price?

This is the trickier part. I believe that Intel is a wonderful company with great leadership. Pat Gelsinger is tough on turning Intel around, and he's done a great job of returning Intel to a much more competitive position in the industry.

The key question we must ask ourselves is, "What expectations are already baked into the stock price, and what potential developments have yet to be accounted for?" The story of Intel's resurgence, with its foundry business as the centerpiece, is undoubtedly captivating. However, if the market has already factored this narrative into the stock's valuation, we might need to temper our enthusiasm. It's important to remember that even an exceptional company can face headwinds if its stock price implies a future without setbacks. In such a scenario, any stumble along the way could lead to a harsh reality check for investors.

Intel stock is in a precarious predicament right now. With a P/E of ~104 and a forward P/E of ~28, it's not the discount value I'd prefer. There's not a margin of safety, and a lot can go wrong. Intel's CFO David Zinsner knows this very well.2

Conclusion

Intel is embarking on an ambitious journey to reclaim its position as a leader in the semiconductor industry. With the introduction of IDM 2.0 and the commitment to delivering 5 nodes in 4 years, the company is showing its determination to innovate and compete with rivals like TSMC. The new segment reporting structure, which emphasizes the importance of Intel Foundry, reflects the company's strategic focus on this critical aspect of its business.

However, investors must approach Intel stock with caution. While the company's narrative is compelling, the financial metrics paint a less optimistic picture. Terrible margins, decreasing revenues, and a ROIC are all causes for concern. Additionally, with a high forward P/E ratio and a lack of a margin of safety, there is a risk that the market has already priced in much of Intel's potential success.

Ultimately, Intel's future hinges on its ability to execute its ambitious plans and deliver on its promises. If the company can successfully navigate the challenges ahead and regain its competitive edge, it may prove to be a lucrative investment opportunity. However, investors must carefully weigh the potential rewards against the substantial risks before making a decision to invest in Intel stock. As with any investment, thorough due diligence and a long-term perspective are essential.

Footnotes

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post Intel New Segment Webinar Notes appeared first on Walsh Investment Strategy.