Quarterly Letter – Q1 2024

It's been a great quarter. While I didn't beat the market, I made a pretty good return. In this quarterly letter for Q1 of 2024 I'm going to cover performance, strategy, market outlook, portfolio makeup, and a few quotes that stuck out to me these past few months. Let's dive in.

Summary

I made a return of 7.51% for Q1 while the benchmark S&P 500 made a return of 10.56%. This brings annualized results to 22.8% for the portfolio and 11.5% for the S&P 500 (including dividends reinvested).

One quarter is the equivalent a heartbeat in investing, but it's still nice to keep a 'thumb on the pulse' when measuring long term performance.

My market outlook is rosy, with wonderful companies in the portfolio continuing to grow into their respective valuations.

Learning from experience in investing is not enough. We must learn from others by reading often, widely, and deeply. The cost of making firsthand mistakes is too great.

Table of contents

Performance

Portfolio Performance Overview

It's rare that the S&P 500 has such a good quarter. Am I worried about it? Of course not. Rising tides lifts all boats. While I didn't beat the benchmark, I still did great. ~7% in a quarter is phenomenal, but one quarter is the equivalent of the blink of an eye in investing. In the below table I had MTD numbers but took them out. It may as well have been hourly numbers.

QTD YTD 1Y Annualized* S&P 500** 10.6% 10.6% 34.4% 11.5% Portfolio 7.5% 7.5% 42.1% 22.8%

Performance data is indicative and should not be considered as advice. *Inception date: 2022-04-18. **S&P500 includes dividends reinvested.

It's significant to acknowledge that a 7 percent return in one quarter is exceptionally high. Considering the S&P 500 typically averages about 12 percent annually, my portfolio's 7 percent quarterly return compared to the market's 10 percent quarter gain is quite an outlier. Nevertheless, I take great pride in this achievement.

It makes for an interesting visual:

I would be lying if I said I wasn’t proud of this overall performance. It should be noted that all gains (and losses) in investing have a mixture of both luck and skill. The best way to discern the two is to have a large enough sample to show whether it is truly luck or skill. Since this has been almost exactly two years, I am now sure that at least 10% of the above returns are skill.

You read that correctly. It would be silly to say “that’s all skill”.

Subscribe

✓ Get smarter

✓ Invest wisely

✓ Never miss a thing

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you! (Your info is private and will never be sold to anyone else, ever.)

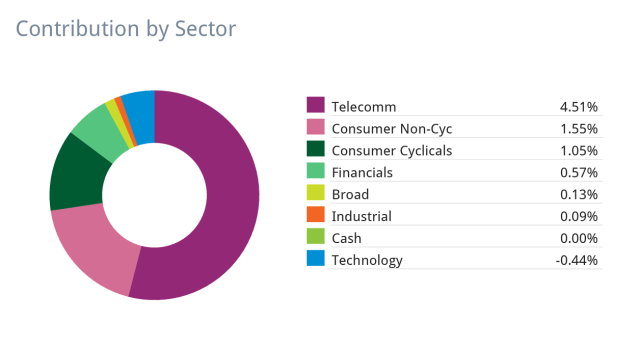

Performance By Sector

Here is performance by sector. As you can see, it's been a great quarter for Telecomm with 4.51% return and the Consumer Non-Cyclical returning another 1.55%. Technology was the only drag sector with -0.44% return.

You can see how the benchmark beat my portfolio and why. This is erring on the side of getting into the weeds a little too much for one quarter, but it's still interesting to see how my specific sector performance vs the benchmark.

Strategy

What It Is

Here is my basic investing strategy. Keep in mind that this is an evolving practice and will change over time:

Buy "amazing companies at reasonable prices." This is the primary driver and guides the remainder of the strategy.

Long Only: No short positions. I think shorting companies alters the mind and sets a precedent for behavior that goes against long-term mental health. (Mr. Market is crazy)

Fundamental: Looking at the underlying numbers of a company, the industry and sector it competes in, understanding product/services and customers, is a far better use of time and energy than drawing arbitrary lines on a chart.

Barbell Strategy: Invest in a mix of high-risk, high-reward companies and more stable, income-generating companies. This strategy aims to capture significant upside potential while mitigating overall portfolio risk.

Sensible Portfolio Management: Only 10-15 companies in the portfolio at a time, not including starter positions (positions =<1% weight).

Patience: Long-term perspective with an ideal investment range of >5 years. This is great for keeping turnover low, which is its own reward.

Independent: Since I am a one-man show, I do not have the inclination to rely on others for thinking. This is a dangerous place to be, but investing, just like anything worth doing, is inherently dangerous. I can thank the Marines for teaching me this: think for yourself.

Continual Learning: This is the lowest urgency and highest importance of the strategy. "Go to bed smarter than when you woke up" is a great way to increase your luck in the long run.

What It Isn't

Articulating what a strategy is not can be just as important as defining what it is. This provides clear boundaries and prevents the strategy from drifting off course. While stating the affirmative pillars of an investing approach is crucial, explicitly calling out what has been rejected helps maintain focus and discipline. By steering clear of certain investing pitfalls and distractions, we can build a more robust, differentiated strategy. With that in mind, here are some key elements that this strategy avoids:

Reaching for alpha/beating the market. Beating the market or benchmark is a byproduct. As a great coach once said "the score takes care of itself." Worded another way: focus on what you can control. Or "Front Sight Focus" as they say in the Marines.

An attempt at being smart: I will be the first one to tell you that I am not smart. Far from it, in fact. My only edge is that I know that I'm not smart. There are zero points for being smart in this game, and convincing yourself of being smart is the surest way to ruin.

Timing the market: As I've said before, timing the market is a fools errand and should be avoided at all costs. Predicting the short-term market fluctuations is like predicting cat movements. Just stupid.

Fun: If it's boring and it works, it's not boring. If you want to have fun, watch a movie or do something else besides wildly buying and selling in the stock market. Fun, for me, is removing blind spots and improving a strategy. That's it. This means continual learning (point 8 above).

The Importance of Reading

The most important and least urgent thing I can think of that contributes to long-term success deserves a little extra emphasis. These two quotes stand out to me because 1) they come from the greatest practitioners, and 2) they point to the fact that these two wildly successful thinker/doers place a heavy emphasis on prioritizing the important over the urgent:

“I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business. I do it because I like this kind of life.”

Warren Buffett

If that wasn't enough, my favorite Leader and Marine, General Mattis quoted:

If you haven’t read hundreds of books, learning from others who went before you, you are functionally illiterate—you can’t coach and you can’t lead. History lights the often dark path ahead; even if it’s a dim light, it’s better than none. If you can’t be additive as a leader, you’re just like a potted plant in the corner of a hotel lobby: you look pretty, but you’re not adding substance to the organization’s mission.

Former U.S. Secretary of Defense James Mattis

I think many years of one's life can be improved drastically if they take the wisdom of those who came before and apply them.

Market Outlook

Equities Are Expensive (but not a bubble)

While there is often concern about the state of the market, which can tempt one to try timing the market, I aim to avoid that practice. Timing the market is a fools errand.

The best thing we can do is learn, observe, and share our opinions in hopes of updating our beliefs. Investing, after all, is an exercise in attempting to see the world as accurately as possible. This requires the continual elimination of blind spots. There has been lots of chatter about the overvalued nature of the stock market, but it doesn't warrant worry.

Below we see the Trailing Twelve Months (TTM) for the S&P 500 in the last ten years, with standard deviation highlighted. Notice how much the S&P 500 climbed in valuation this Q1 2024.

The current TTM P/E of 27 is higher than I'd like, but we just had a stellar quarter, so what does this mean?

It means things are expensive when looking back. Nobody knows what tomorrow brings.

Inflation: That Nasty Feature

Inflation is a bane on the existence of the rest of the world that isn't lucky enough to invest. This is just a note, but I think it's worth paying a bit of attention to.

It's also important to note that nobody knows what the FED is going to do regarding rates. I think they're doing a good job though. Let them do their job, and focus on yours (Front Sight Focus).

Quarter-End Portfolio

Here is the full portfolio as of the end of Q1 2024, along with average weight, return, and contribution to portfolio performance:

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post Quarterly Letter – Q1 2024 appeared first on Walsh Investment Strategy.