36: Unemployment Rate Ticks Slightly Higher

Welcome to Sunday Edition, where I cover the markets, economy, and uncover hidden gems across the internet. I'm keeping it short and sweet this week.

Quote of the week

“The difference between successful people and really successful people is that really successful people say no to almost everything.”

Warren Buffett

I still believe this. Some might say Warren Buffett is getting too much attention lately with the recent passing of Charlie Munger, but I disagree. Saying "no" to the good so we can focus on the truly exceptional is a logical strategy that most do not take.

Markets

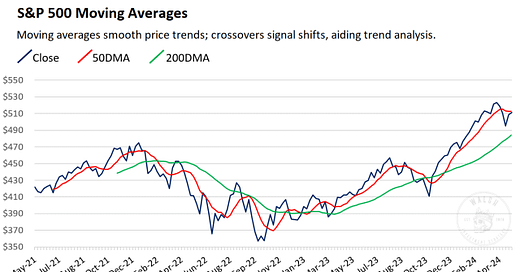

The Index and the Nasdaq both up last week with the overall bond market up as well. Good news for the rational optimists, bad news for the perma-bears.

Still, the index is not where it topped out earlier this month:

Subscribe

Get posts just like this one sent to your inbox when they're published:

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you!

Economy

The unemployment had a slight uptick to 3.9%. With the fed keeping rates higher for longer I'm curious to see where unemployment peaks in this cycle.

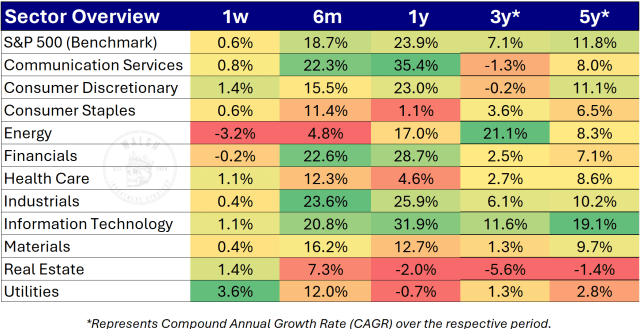

Sectors

Utilities had a heck of a week with 3.6% increase while energy got knocked down a peg with -3.2%.

Internet Gems

As many of you know, Charlie Munger recently passed. At the Berkshire Annual Meeting, Warren Buffett spoke about what he'd do if he had one more day with Charlie. The below is worth the time. (You can check it out here: https://x.com/compound248/status/1786794618094305449)

“Hi, my name is Andrew and I’m wondering if you had more day with Charlie, what would you do with him?“

The most poignant question of the day came from a child.

Buffett’s answer eulogized Charlie and sprinkled fabulous life advice throughout.

“[Charlie and I] never had any… pic.twitter.com/jqwA5dICva— Compound248

(@compound248) May 4, 2024

Portfolio

Still clicking along at ~21% annualized (which is exceptional) while underperforming both QTD and YTD. I keep thinking about periods of underperformance and how arbitrary they are. This is a dangerous area of thinking, as it can be the tail wagging the dog since I'm underperforming QTD and YTD, but I think it's something that warrants diving into.

It's important to talk about goals, and to get them out in front so we can "poke them with our brains." My main goal is not to outperform the market, or to have a 20% annualized return, but to secure financial freedom for myself and my family by investing in wonderful companies.

I'll probably write more on this down the road.

Anyway, here's my performance vs the S&P 500:

QTD % YTD % 1 Year % Since Inception Annualized S&P 500* -2.3 8.0 27.3 20.7 10.1 Portfolio -2.9 4.4 31.4 44.8 21.9

Performance data is indicative and should not be considered as advice. *S&P500 includes dividends reinvested. Inception date: 2022-04-18.

Below is my current portfolio sorted by weight:

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post 36: Unemployment Rate Ticks Slightly Higher appeared first on Walsh Investment Strategy.