Microsoft Q3’24: Cloud surpasses $35 Billion in Revenue

Microsoft really knocked it out of the park in their Q3'24. For this post I'm covering high-level earnings and just a couple thoughts about the future of Microsoft. (If you want to check it out, go here: FY24 Q3 - Press Releases - Investor Relations - Microsoft)

TLDR: Microsoft is a beast and keeps finding ways of providing maximum value to customers as you can see in the rest of this post. They are one of my personally favorite companies.

Summary

Strong financial performance: Microsoft reported impressive growth across key metrics, with total Q3 revenue of $61.9 billion (up 17%), earnings per share of $2.94 (up 20%), and Microsoft Cloud revenue surpassing $35 billion (up 23%).

AI-driven growth: Azure AI customers and average spend grew significantly, contributing to a 7-point lift in Azure growth. Microsoft's AI investments, including Copilot offerings, are driving efficiency and transforming various industries and business processes.

Continued investment in cloud and AI infrastructure: Microsoft plans to increase capital expenditures to support the growing demand for cloud and AI products, recognizing the significant opportunities in this space. The company expects double-digit revenue and operating income growth in FY '25.

Strong product and service performance: Various Microsoft products and services showed impressive growth, including Azure Arc, Microsoft Fabric, GitHub Copilot, Dynamics 365, LinkedIn, Bing, and Xbox content and services.

Addressing data quality and capacity constraints: Microsoft acknowledges the importance of data quality for successful AI deployment and highlights the availability of tools and the role of system integrators and developers in addressing these challenges. The company is also prioritizing capacity allocation to support the growth of per-user businesses, such as Microsoft 365 Copilot.

Subscribe

✓ Get smarter

✓ Invest wisely

✓ Never miss a thing

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you! (Your info is private and will never be sold to anyone else, ever.)

Table of Contents

Financial Results

I said what I said

On July 29, 2023 I stated my firm belief that Microsoft would continue to dominate in cloud and AI:

Microsoft is going to continue to dominate the cloud and AI space, and they’re going to continue to invest in their infrastructure to support this growth.

Earnings Update: Microsoft Q4'23 - Walsh Investment Strategy

While this is currently holding true, I'm much more cautious of my wording.

What I should have said is "I think that the team at Microsoft has demonstrated extreme levels of competence so much that I believe they have a high likelihood of success in the cloud and AI space."

Revenue

Microsoft increased revenue 17% surpassing 60bil in one quarter. This is mind-boggling:

Earnings

Healthy earnings growth YoY:

Our third quarter revenue was $61.9 billion, up 17% and earnings per share was $2.94, up 20%. The results exceeded expectations, and we delivered another quarter of double-digit top and bottom line growth with continued share gains across many of our businesses.

Amy Hood

Profit Margins

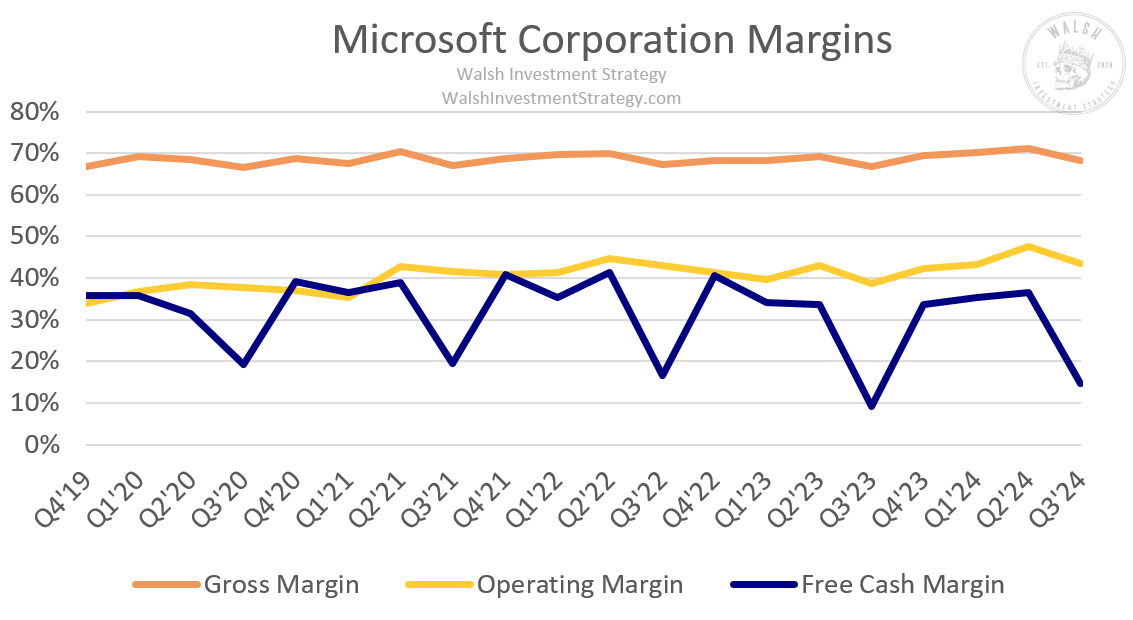

Microsoft margins are an amazing feat of business all the way down to FCF margin of roughly 10-40 percent in a given quarter. Q3 seems to always give a return of ~10% FCF margin.

Notice the increase in Operating Margin over time from ~35% to the mid 40s. This is great to see.

Segment Performance

Intelligent Cloud is pulling away from Productivity and Business Processes segment.

Key Developments

Github Copilot Taking Over

GitHub Copilot is bending the productivity curve for developers. We now have 1.8 million paid subscribers with growth accelerating to over 35% quarter-over-quarter and continues to see increased adoption from businesses in every industry, including Itau, Lufthansa Systems, Nokia, Pinterest and Volvo cars. CoPilot is driving growth across the broader GitHub platform, too. AT&T, Citi Group and Honeywell all increased their overall getup usage after seeing productivity and code quality increases with CoPilot. All up more than 90% of the Fortune 100 are now GitHub customers and revenue accelerated over 45% year-over-year. Anyone can be a developer with new AI-powered features across our low-code, no-code tools, which makes it easier to build an app, automate workflow or create a Copilot using natural language. 30,000 Organizations, across every industry have used Copilot studio to customize Copilot for Microsoft 365 or build their own, up 175% quarter-over-quarter. Cineplex, for example, built a Copilot for customer service agents, reducing query handling time from as much as 15 minutes to 30 seconds. All up over 330,000 organizations, including over half of Fortune 100 have used AI-powered capabilities in Power Platform, and Power Apps now has over 25 million monthly active users, up over 40% year-over-year.

Satya Nadella, Q3'24 Earnings Call Transcript

Guidance and Outlook

We continue to focus on building businesses that create meaningful value for our customers and therefore, significant growth opportunities for years to come. In FY '25, that focus on execution should again lead to double-digit revenue and operating income growth to scale to meet the growing demand signal for our cloud and AI products, we expect FY '25 capital expenditures to be higher than FY '24. These expenditures over the course of the next year are dependent on demand signals and adoption of our services.

Amy Hood, Q3'24 Earnings Call Transcript

Microsoft is growing double digits for FY'25 and capex will be higher than FY'24? I'm shocked! No but seriously, Microsoft is investing capex very well. I'm impressed.

We will also continue to prioritize operating leverage. And therefore, we expect FY '25 operating margins to be down only about 1 point year-over-year, even with our significant cloud and AI investments, as well as a full year of impact from the Activision acquisition.

Amy Hood, Q3'24 Earnings Call Transcript

Overall I'm very pleased with the outlook. Simple, straight forward, effective. I see no reason to anticipate anything beyond this guidance, barring a cataclysmic event.

Valuation

Right now MSFT stock is more expensive than it has been for a while when looking at historical data for the past 5 years:

Here's historical P/E (NTM):

MSFT is expected to do quite well in the future. They've shown to be quite capable of growing earnings as expected, but the risk is getting to the point of teetering.

Conclusion

Leadership and Strategy

They're huge, essential to almost every business in the US, and becoming even more essential as AI becomes a necessary commodity. Here's where I think Microsoft is headed and a word on portfolio risk management:

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post Microsoft Q3’24: Cloud surpasses $35 Billion in Revenue appeared first on Walsh Investment Strategy.