NVIDIA Corporation (NVDA) Q2’25 Earnings Update

NVIDIA Corporation posted their Q2’25 earnings a while back. In this post I cover what I found to be interesting. You can download the model here: NVDA Model 2024-09-18 Q2’25

Summary

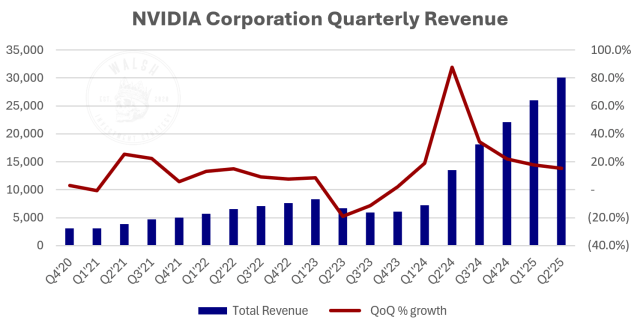

Business Is Booming: Revenue is up $30b, 15% sequentially and 122% YoY. “For the quarter, GAAP earnings per diluted share was $0.67, up 12% from the previous quarter and up 168% from a year ago.”

Happy Customers: “The people who are investing in NVIDIA infrastructure are getting returns on it right away. It’s the best ROI infrastructure, computing infrastructure investment you can make today.”

Demand Exceeds Supply: NVIDIA has customers chomping at the bit for product, which is great.

The Prettiest Semiconductor Company At The Dance: NVIDIA has all the attention and demand right now. Wonderful company.

Financial Results

From the Q2’25 earnings call:

Revenue of $30 billion was up 15% sequentially and up 122% year-on-year, and well above our outlook of $28 billion.

Starting with Data Center. Data Center revenue of $26.3 billion was a record, up 16% sequentially and up 154% year-on-year, driven by strong demand for NVIDIA Hopper, GPU computing and our networking platforms. Compute revenue grew more than 2.5x. Networking revenue grew more than 2x from the last year.

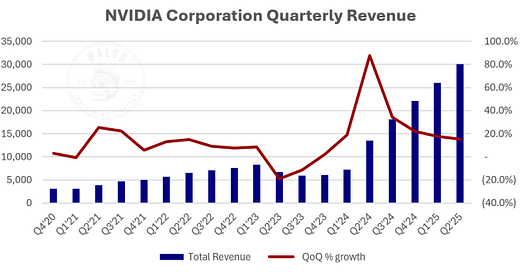

Overall it was a great quarter. Quarter-over-quarter growth slowed to 15.3%, which seems small compared to the recent run-up, but still healthy numbers:

While sequential QoQ growth seems small, YoY numbers are still amazing. Compute & Networking is up 154% YoY. Click to enlarge:

Compute & Networking are now by far the dominant segment:

Of course, this leads us to pay attention to product leadership in compute & networking.

Product Updates

It looks like NVIDIA is well-positioned as the AI boom continues:

Key workloads driving our Data Center growth include generative AI model training and inferencing; video, image and text data pre- and post-processing with CUDA and AI workloads; synthetic data generation; AI-powered recommender systems; SQL and Vector database processing as well. Next-generation models will require 10 to 20x more compute to train with significantly more data. The trend is expected to continue.

Compute and networking are both growing quite a bit, but compute still makes up the majority of the revenue:

Market Demand

Demand is still strong and with Blackwell rolling out:

Hopper demand is strong and Blackwell is widely sampling. We executed a change to the Blackwell GPU mass to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26. In Q4, we expect to get several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025.

Hopper supply and availability have improved. Demand for Blackwell platforms is well above supply, and we expect this to continue into next year.

Pretty cool what they’re doing:

With the NVIDIA MGX modular reference architecture, our OEMs and ODM partners are building more than 100 Blackwell-based systems designed quickly and cost effectively. The NVIDIA Blackwell platform brings together multiple GPU, CPU, DPU, NVLink and Link Switch and the networking chips, systems and NVIDIA CUDA software to power the next generation of AI across the cases, industries, and countries. The NVIDIA GB200 NVL72 system with the fifth-generation NVLink enables all 72 GPUs to act as a single GPU and deliver up to 30x faster inference for LLM’s workloads and unlocking the ability to run trillion-parameter models in real time.

Subscribe

✓ Get smarter

✓ Invest wisely

✓ Never miss a thing

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you! (Your info is private and will never be sold to anyone else, ever.)

Outlook

Expecting continued demand, revenue growth, high margins, and nothing scary under the hood.

Valuation

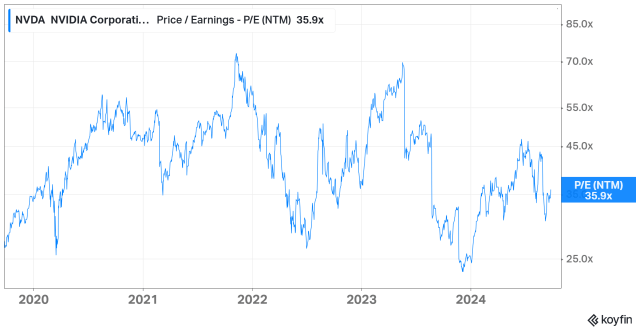

With all of this, NVIDIA is still reasonably priced, even after the extraordinary YTD performance:

NVIDIA NTM multiple looks healthy and not unreasonable, but not a bargain either:

Closing Thoughts

One of the main concerns I have with NVIDIA is their ability to stay at the forefront of technology. Demand is high right now, but that is not guaranteed in the future. I don’t think it’s likely that NVIDIA gets surpassed in the long-term. They are improving at a phenomenal rate. I think this speaks to the quality of the company and leadership of Jensen Huang.

One of the main signposts I’m watching for here is a change in technology leadership. This seems to be a simple (but not easy) game of best product wins.

Every time I read about NVIDIA I come away with more questions than answers, but these help:

If you want to check out the latest earnings material from NVIDIA, you can go here: NVIDIA Corporation – Financial Reports

My other NVIDIA posts: NVDA Archives

Thank you for reading the recap of NVIDIA Q2’25 earnings.

In the spirit of continuous improvement, if you identify any mistakes or areas for refinement, please don’t hesitate to reach out. I am committed to maintaining the highest level of professionalism and will publicly address and correct any errors brought to my attention.

The post NVIDIA Corporation (NVDA) Q2’25 Earnings Update appeared first on Walsh Investment Strategy.