📝 2024 Review

Reading time: 4 minutes

📑 Little Bits

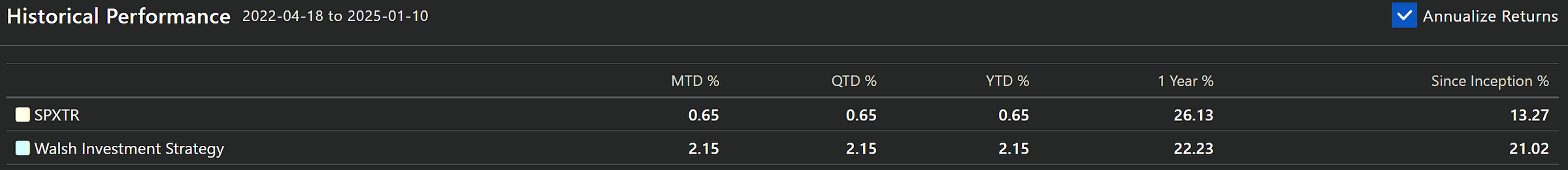

Performance — Q4 was 3.87% vs 2.41% for the benchmark (SPXTR). For 2024 the portfolio returned 18.9% while the benchmark returned 25.02%. Annualized since inception is still 21.02% vs 13.27% for the benchmark. Not bad for an old man in the middle of nowhere in Oregon. All charts below.

Morning Coffee☕— I’m writing a short daily email. Check it out. This is a great way to hear more from me more often. 95% of posts only go out to email. Most emails are less than 150 words. Subscribers are not automatically subscribed. Topics are extremely wide-ranging from investing to fitness to philosophy.

New Portfolio — I’m launching a new portfolio. It’s quantitative in nature. I’ll share more on this later. Because of this I’m renaming the current portfolio to “Core Long-Only” and the new one will be called something metal like “Unforgiving” or something because, well, it’s unforgiving.

📊 2024 Performance

Historical performance 2022-04-18 to 2025-01-10:

Since inception chart:

For those of you who want monthly details, here you go:

Cumulative 2024 performance:

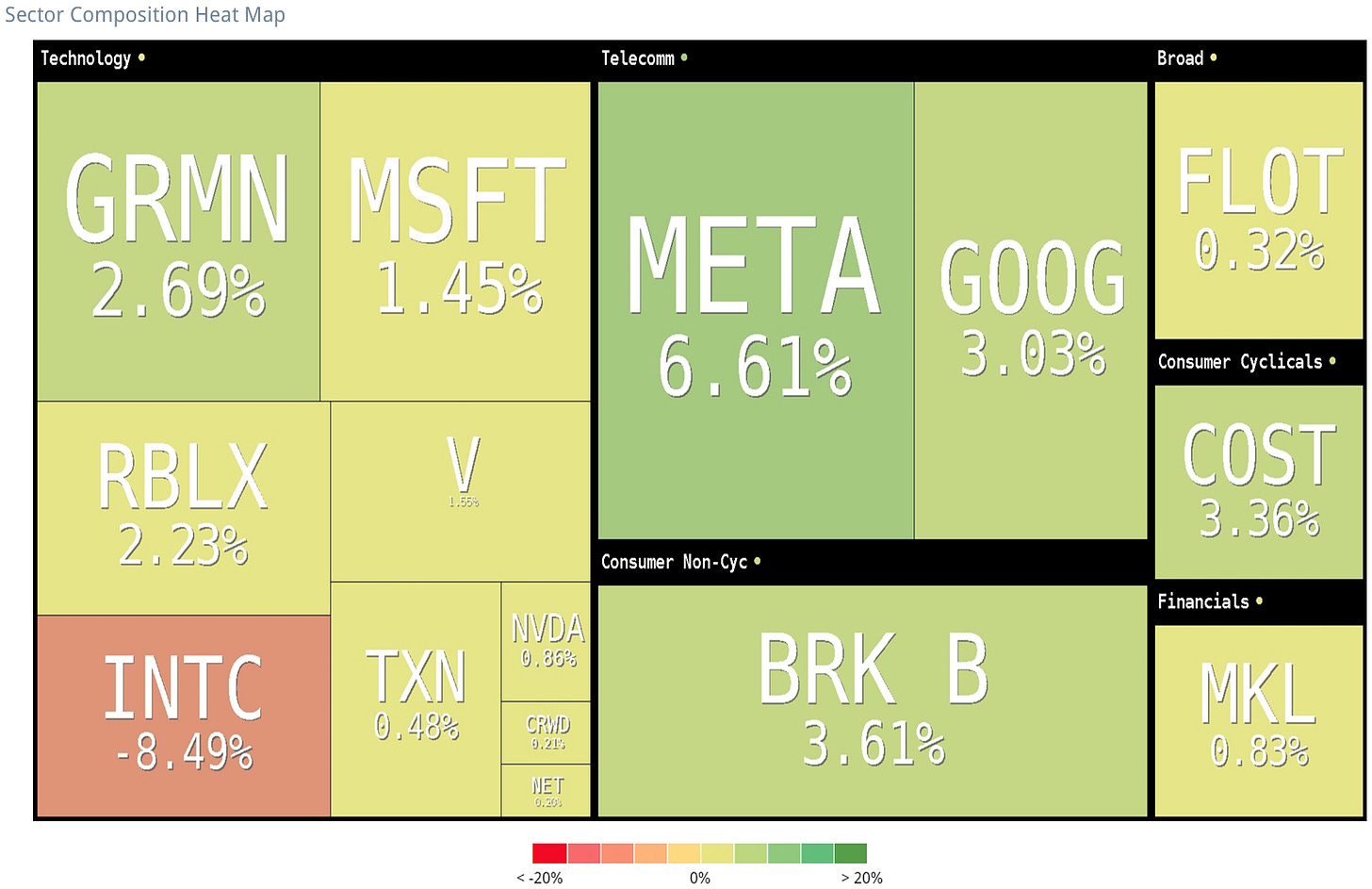

Contribution by sector. Obviously given my preference for tech, this will almost always be dominated by those sectors.

Sector composition and contribution heat map for the year:

Holding INTC 0.00%↑ for the year really brought performance down. Yikes.

💻 INTC 0.00%↑

In 2023 I made a big bet on META 0.00%↑ and bought near the lows to bring the average price down to $133.43. I remember where I was sitting, what the weather was like outside, and the overwhelming feeling of anxiety and nauseousness. Wall Street all had the same message: META was dying. I disagreed. It paid off. But I’ll always remember that monumental feeling of nauseousness and wondering “Did I just throw everything away? What am I missing?” My tendency is safety.

But it paid off. It was more luck than skill. The dangerous part here is the common mistake to regard luck as skill. My brother in-law has a saying: the worst thing that can happen in gambling is win big the first time. This feels like that, and the repercussions are lingering: now I look for overly hated large/mega-cap companies. It seems like Mr. Market is routinely hating on one big business or another, setting up the thoughtful investor with a great setup. I thought this was INTC 0.00%↑ this year. Now either I’m wrong or I’m early (indistinguishable at times), but if the position dragged the portfolio a whopping 8% this year, then I’m most likely wrong.

I remember looking briefly at NFLX 0.00%↑ and SPOT 0.00%↑ near the lows in 2022-2023 and thinking “This is the end for those loser companies” and consequently missed out on amazing setups. I simply did not understand the thesis. Combine the extreme lows with Mr. Market’s latest over-enthusiasm and you get some amazing returns since late 2022:

In hindsight, these companies were probably a better setup than INTC 0.00%↑ was at the time. It’s been a great lesson in always keeping an eye open for over-hated companies and not just watching the companies I think are interesting.1

I remember watching Alex at TSOH Investment Research (check him out here) writing about Netflix and thinking “Oh boy, this guy is so wrong” 🥲 but that man was as right as it gets.

Anyway, INTC 0.00%↑ is trading close to tangible book value (TBV) and the trend has shown this isn’t the norm. Given the geopolitical risk of TSM 0.00%↑ and the need for US chip production well into the future, it seems to me that INTC 0.00%↑ is the only option. I’m talking more about the foundry side than the products side, but you get the idea. x86 is a small point in this game while foundry is such a huge deal.

To me it seems that INTC is priced like it’s just about dead. The future is uncertain, but I like the current probabilities.

🧐 Goodbye

Thank you for reading. If you have any questions, you had better ask.

PS — My daughter is fascinated by AI and how I can describe something then watch it appear. She wanted to share this with all of you: a lion eating spaghetti:

Until next month 🫡

Michael

I think over-hated is different than under-valued, but that’s a whole other post for later.

I like your point about looking for hated large-cap companies. Big success with $META, and I think $INTC will work out nicely. Thanks for sharing Michael!

Thanks for the shoutout - and thankfully NFLX was right!