32: Luck Surface Area, Unemployment, Portfolio Holdings, Economy

Good morning! This week I'm diving into the unemployment rate, labor force participation rate, market overview, sectors, economy, and portfolio performance. There's also a little internet gem that I got a kick out of this week.

Table of contents

What's New

New post on Intel changing how they report segments. Check it out.

Have an idea for the newsletter or website? Take the shortest survey on the planet.

Sector overview now displays CAGR for 3 and 5 year time periods instead of total return. Thank you, Simon, for the suggestion!

"Portfolio" section now includes portfolio snapshot, weight, P/E, and FWD P/E.

Quote of the week

"Look at the word responsibility—“response-ability”—the ability to choose your response. Highly proactive people recognize that responsibility. They do not blame circumstances, conditions, or conditioning for their behavior. Their behavior is a product of their own conscious choice, based on values, rather than a product of their conditions, based on feeling."

Stephen R. Covey, The 7 Habits of Highly Effective People

Markets

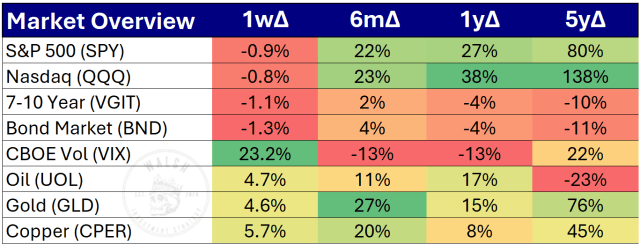

Markets took a bit of a slip this week with the VIX bumping up quite a bit. Of course, bears will take their victory laps with oil, gold, and copper ripping a bit this week, but nobody knows what next week (or next year) will bring.

I'm still bullish progress and sensible portfolio management.

When we zoom out and look at the last three years of the index, we see this week's decline is minimal:

Economy

The unemployment rate is ticking lower. You can view this a couple different ways, but the way I view it is people are getting a little more squeezed into working.

The labor force participation rate swing up quite a bit.

I'm not worried about it.

Sectors

As stated at the beginning of the post, I changed how sectors are reported. I added the 3y and now have 3y and 5y as CAGR, not total return. This aligns a bit better with the portfolio section of the newsletter.

Energy came back with a vengeance this week, up 3.8%. Information technology still brings the cake with a 5y CAGR of 20.2%.

Internet Gems

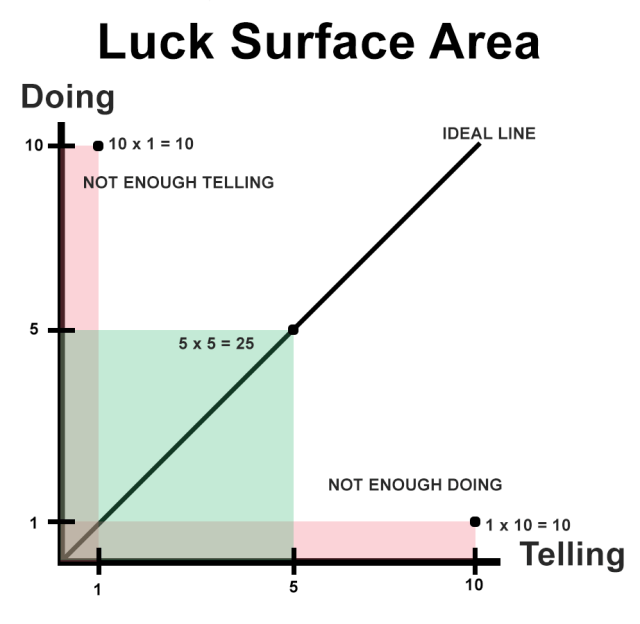

A member shared this great website: Luck Surface Area | Mental Model Practices (mmpractices.com)

I highly suggest you check it out and bookmark it. From the above link:

I like this idea of telling/doing. It's very close to the say/do ratio from Intel's latest segment presentation. It's also a great reminder to all of us. I'm sure we all lean towards telling too much, or doing too much, and not a proper mixture of both.

When in doubt, err on the side of 'Doing'.

Portfolio

Here is the current portfolio, weightings, and a few more details. (This will be a standard addition to the newsletter)

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post 32: Luck Surface Area, Unemployment, Portfolio Holdings, Economy appeared first on Walsh Investment Strategy.