38: Core CPI, Housing Starts, Applied Materials, John Deere

Welcome to Sunday Edition, where I cover the markets, economy, and uncover hidden gems across the internet. This week I'm covering Core CPI, Housing Starts, Applied Materials, and John Deere along with the standard indices and markets.

A note before we get into it: There's a lot of chatter elections in investing, and how to 'invest during the election year.' I think it's nonsense. I wrote about this back in 2020 and my thoughts haven't changed on the subject: Election Elation

What's New

You can now search and filter by tag in the library. Check it out.

Quote of the week

"Hardness scares off the daydreamers and the timid, leaving more opportunity for those like us who are willing to take the time to carefully work out the best path forward and then confidently take action."

Cal Newport, So Good They Can't Ignore You

Subscribe

✓ Get smarter

✓ Invest wisely

✓ Never miss a thing

SUBSCRIBE!

Check your inbox to confirm your subscription. Thank you! (Your info is private and will never be sold to anyone else, ever.)

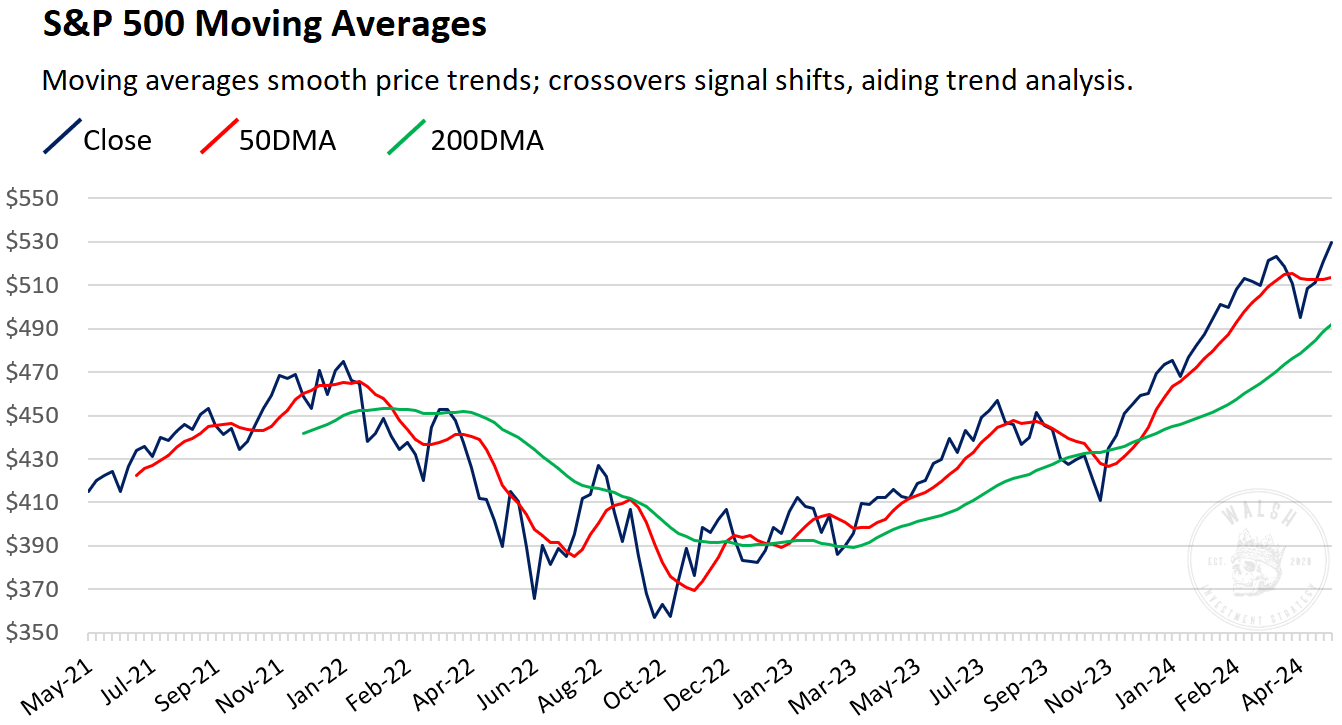

Markets

Economy

Core CPI Trending Down

Housing Starts

Sectors

Company Updates

Applied Materials (AMAT)

Semiconductors are the foundation of major technology trends like AI, IoT, electric vehicles, and clean energy.

AI is highlighted as the biggest technology inflection, driving demand for advanced chips.

Applied Materials has leadership in key areas: leading-edge logic, high-performance DRAM, high-bandwidth memory, and advanced packaging.

Gate-all-around transistors and backside power delivery are expected to significantly grow Applied's available market.

Revenue from gate-all-around nodes is expected to be over $2.5 billion in 2024, potentially doubling in 2025.

HBM packaging revenue could be 6x higher in 2024 compared to 2023, growing to over $600 million.

Advanced packaging product portfolio revenue is expected to grow to approximately $1.7 billion in 2024.

In terms of impact and scale, I believe AI will be the biggest technology inflection of our lifetimes. And at the heart of AI are some of the world's most sophisticated chips. In simple terms, the advanced chips that power AI data centers are enabled by 4 key semiconductor technologies: leading-edge logic; compute memory or high-performance DRAM; DRAM stacking technology referred to as high-bandwidth memory, or HBM; and advanced packaging to connect the logic and memory chips together and create a system in a package. Applied has process technology leadership in all 4 of these areas, and we have made significant investments in next-generation solutions to make possible the key device architecture inflections that are essential for our customers' future road maps. In advanced logic, Applied has long-standing leadership in the materials engineering processes for both transistors and interconnects.

Gary Dickerson, CEO

John Deere (DE)

Deere's Q2 net sales and revenues were down 12% to $15.235 billion, with equipment operations net sales down 15% to $13.61 billion.

Net income attributable to Deere & Company was $2.37 billion or $8.53 per diluted share.

The equipment operations margin for Q2 was 21.2%.

Operating margin for the production and precision ag segment was 25.1%, down due to lower shipment volumes and higher production costs.

Operating margin for the small ag and turf segment was 17.9%, also down due to lower shipment volumes.

Operating margin for the construction and forestry segment was 17.4%, impacted by lower shipment volumes and higher R&D and SA&G expenses.

One other thing to highlight beyond the current environment, and where we see the long-term strategy leading us, is related to technology and how we engage with our customers. We're starting to think about market share, not only as the number of units sold but as the number of acres covered by Deere products and technologies as a percentage of total acres farmed. In the future, we're going to continue accelerating the utilization of technology as we grow our precision upgrade retrofit business as well as Solution-as-a-Service offerings.

While all parts of the world are seeing growth, Brazil is growing faster than North America on both engaged and highly engaged acres, which is a positive sign as we bring more technology to the market, in particular with satellite communications coming soon. And customers there see increased value given the multiple crop harvest each year as well as the ability to improve efficiency, profitability and sustainability in their operations.

Josh Jepsen, CFO

You can read more here: John Deere - SEC Filings - SEC Filings Details

Portfolio

Still kickin ass a bit YTD, not so much this quarter.

QTD % YTD % 1 Year % Since Inception Annualized S&P 500* 1.1 11.8 29.5 24.9 12.0 Portfolio -0.3 7.2 30.3 48.8 23.4

Performance data is indicative and should not be considered as advice. *S&P500 includes dividends reinvested. Inception date: 2022-04-18.

Here is the current portfolio:

Subscribe to Walsh Investment Strategy to unlock.

Become a paying member of Walsh Investment Strategy to gain access.

A membership gets you:

✓ Premium Research

✓ Sunday Edition Email

✓ Real-Time Portfolio Updates

✓ Community Access

✓ Inner Circle

The post 38: Core CPI, Housing Starts, Applied Materials, John Deere appeared first on Walsh Investment Strategy.